Second Chance Apartments in Austin: How Approval Really Works

Here’s something most apartment websites won’t tell you: that denial you got last week mighty not have had nothing to do with your credit score. I’ve seen renters with 650 scores get rejected while someone with a 520 gets approved down the street. The difference? Knowing which communities actually work with your specific situation, and which ones are wasting your application fee.

If you’re searching for second chance apartments in Austin, you’ve likely already burned through $200, $400, maybe more applying to places that were never going to approve you. That’s not your fault. The big listing sites show you everything but tell you nothing about screening criteria. And “case by case basis” is just code for “we don’t want to say no upfront.”

I’m Ross Quade. I’ve spent 20+ years in real estate and have lived in Austin for 14 years. These days I focus exclusively on apartment locating because I genuinely care about helping people find housing, especially when the deck feels stacked against them. I’ve worked with just about every scenario you can think of, evictions, broken leases, bad credit, felonies, and every combination in between. I’ve gotten people approved weeks after an eviction because I know which communities will work with them.

But let me be upfront: if you’re a registered sex offender, I’ll stop you right there. I just can’t help in those situations, unfortunately, and I don’t want to waste your time or mine. For everyone else, keep reading.

This guide covers the specific screening thresholds, the third-party approval process that nobody else explains, income verification tricks that trip people up, and which Austin areas actually have inventory for your situation. By the end, you’ll know exactly where you stand and what your real options are.

Table of Contents

- What “Second Chance” Actually Means

- The Real Screening Requirements

- Credit Problems? Here’s What Actually Matters

- Evictions and Broken Leases: The Real Impact

- Criminal Background: What Can (and Can’t) Be Helped

- Third-Party Approval: The Process Nobody Else Explains

- Income Verification: The SNAAPT Trap

- Where to Look: Austin’s Second Chance Landscape

- Net Effective Rent: What You’ll Actually Pay

- How to Apply (And Not Waste Money)

- Situations I Can’t Help With

- Why Work With an Apartment Locator?

- FAQ

- Ready to Find Your Second Chance Apartment?

What “Second Chance” Actually Means (And Doesn’t Mean)

Quick Answer: Second chance apartments are rental communities with flexible screening criteria that approve applicants with credit issues, evictions, broken leases, or criminal backgrounds that would disqualify them elsewhere. They’re not “no requirements” housing, you’ll still need to qualify, just through different pathways.

Let me clear up the biggest misconception right now: “second chance” doesn’t mean “anyone gets approved.” It means the community has established criteria for working with specific situations that other properties reject outright.

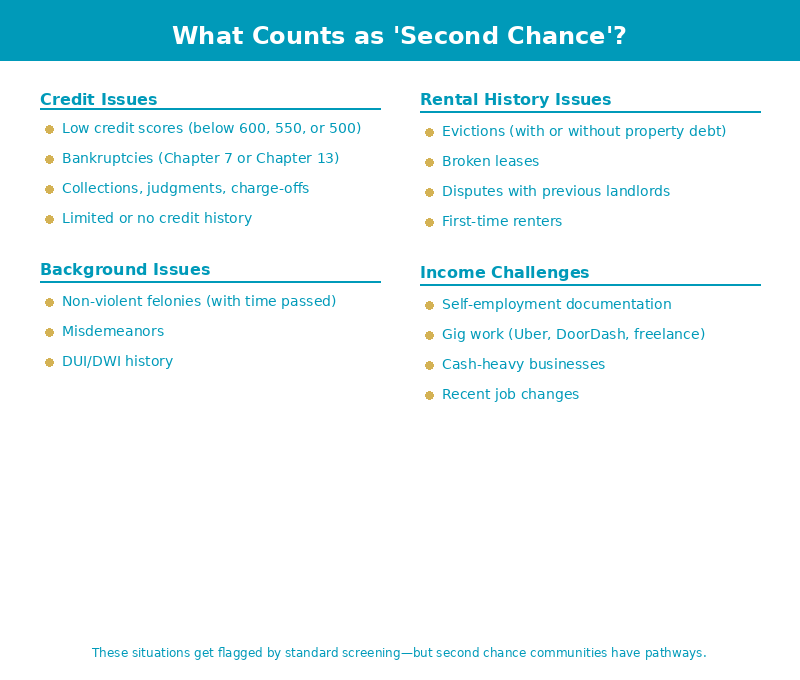

Here’s what qualifies as a second chance situation:

Credit Issues

- Low credit scores (below 600, 550, or even 500)

- Bankruptcies (Chapter 7 or Chapter 13, open or discharged)

- Collections, judgments, charge-offs

- Limited or no credit history

Rental History Issues

- Evictions (with or without property debt)

- Broken leases (with or without property debt)

- Disputes with previous landlords

- First-time renters with no history

Background Issues

- Felonies (non-violent, and some violent with sufficient time passed)

- Misdemeanors

- DUI/DWI history

Income Challenges

- Self-employment with non-traditional documentation

- Gig work (Uber, DoorDash, freelance)

- Cash-heavy businesses

- Recent job changes

The common thread? These are all situations where standard screening algorithms flag you as “high risk – “even when you’re perfectly capable of paying rent and being a good tenant.

What second chance is NOT:

It’s not a free pass. Every community still has requirements, income verification, application process, deposits. The difference is that second chance communities have pathways for approval that others don’t offer.

It’s also not low-quality housing. Some of the nicest Class A properties in Austin have flexible screening, they just don’t advertise it. With vacancy rates around 10% in Austin, Cushman & Wakefield reported 10.2% in Q3 2025, even premium communities are working with applicants they would have rejected two years ago.

Here’s what I tell my clients: know your situation, understand your options, and apply strategically. That’s what the rest of this guide is for.

The Real Screening Requirements (No “Case by Case” Vagueness)

This is where every other guide fails you. They say “requirements vary” or “evaluated on a case-by-case basis.” That’s useless. You need specifics so you stop wasting money on applications.

I’m going to give you the actual thresholds I work with across dozens of Austin communities. These aren’t guarantees, every property makes final decisions, but they’re the real criteria that determine whether you have a shot.

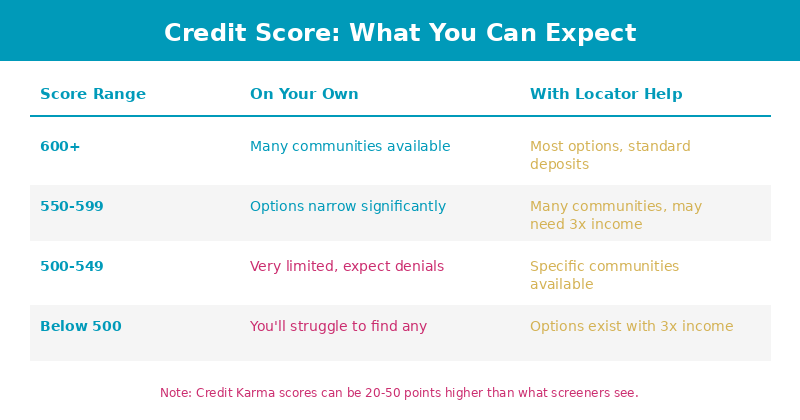

Credit Score Thresholds That Actually Matter

| Credit Score Range | On Your Own | With My Help |

|---|---|---|

| 600+ | Many communities available | Most second-chance communities, standard deposits |

| 550-599 | Options narrow significantly | Many communities, may need stronger income |

| 500-549 | Very limited, expect denials | I have communities for this range |

| Below 500 | You’ll struggle to find anything | Specific communities available, 3x income required |

The difference between searching on your own and working with someone who knows screening criteria? It’s the difference between burning through $500 in application fees and getting approved on your first try.

The Credit Karma Warning

I need to mention this because it trips people up constantly: Credit Karma scores can be 20-50 points different from what apartment screening companies see, and usually higher.

If Credit Karma says 635, you’re probably looking at 600 or lower in reality. That’s not Credit Karma lying to you, it’s using VantageScore, while most apartment screeners use FICO variants. According to FICO, their scores are used in 90% of lending decisions.

Before you apply anywhere, pull your actual credit report at AnnualCreditReport.com, it’s free, federally mandated, and shows you what screeners will see. Check the “Potentially Negative” section on your Experian report specifically. That’s where property debt hides.

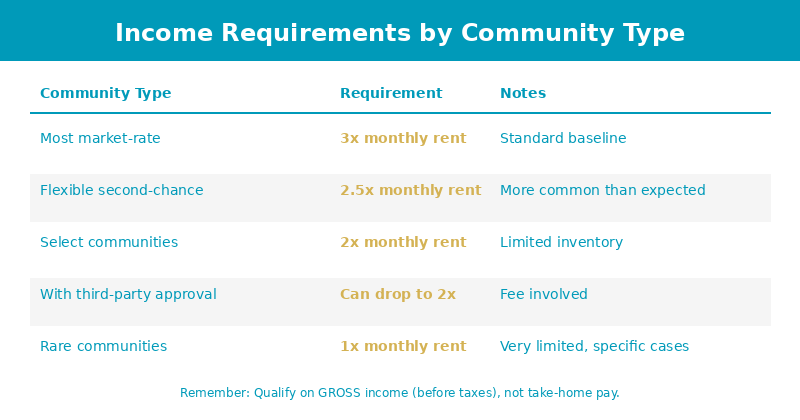

Income Requirements: More Flexible Than You Think

Most renters assume every apartment requires 3x the monthly rent in gross income. That’s the standard, yes. But it’s not universal.

| Community Type | Income Requirement | Notes |

|---|---|---|

| Most market-rate communities | 3x monthly rent | This is the baseline |

| Flexible second-chance communities | 2.5x monthly rent | More options than you’d expect |

| Select communities | 2x monthly rent | Limited inventory, often income-restricted |

| With third-party approval | Can drop from 3x to 2x | Fee involved (explained later) |

| Rare communities | 1x monthly rent | Very limited, specific situations |

A few important clarifications:

Gross vs. net income: Apartments qualify you on gross income (before taxes), not take-home pay. If your paycheck shows $4,000 gross but you take home $3,200, you qualify based on the $4,000.

Combined household income: Everyone on the lease combines their income. If you make 2x rent and your roommate makes 1.5x, together you hit 3.5x, and you qualify.

Self-employed income is “ugly”: That’s the term I use with clients. Gig work, Cash App deposits, Venmo payments: this income is harder to verify. You’ll typically need tax returns or 6 months of bank statements instead of pay stubs. But if you have strong credit (650+), I have communities that skip income verification entirely. More on this in the SNAAPT section.

What the Background Check Actually Looks At

Apartment background checks pull three things:

- Criminal history, Felonies, misdemeanors, pending charges

- Rental history, Previous addresses, eviction records, property debt

- Credit history, Score, payment history, collections, bankruptcies

Under the Fair Credit Reporting Act (FCRA), if you’re denied based on background screening, the community must provide an adverse action notice telling you why. This matters because it helps you understand what’s flagging your applications.

The screening company (RentGrow, TransUnion SmartMove, etc.) isn’t making the approval decision, the property is. The screener provides data; the property interprets it according to their criteria. That’s why the same background can get approved at one community and denied at another.

Credit Problems? Here’s What Actually Matters

Let’s break down credit issues by type, because they’re not all treated equally. A bankruptcy doesn’t hit the same as medical collections. Property debt is completely different from student loans.

Bankruptcies: Chapter 7 vs. Chapter 13

The first question I ask: is it open or discharged?

Chapter 7 (liquidation): Needs to be discharged (closed). Once it’s discharged, most second-chance communities will work with you. It shows on your credit for 7-10 years, but communities understand that a discharged bankruptcy often means you’re starting fresh with no debt.

Chapter 13 (repayment plan): Open is OK. If your payments are current, I have communities that will work with you while you’re still in the plan. They want to see the payment history, proof you’re following through.

Here’s the nuance competitors miss: the type of debt matters too. Medical bankruptcy or a business failure reads differently than maxed credit cards from overspending. I’m not saying communities officially distinguish these, but context matters when a leasing manager reviews a borderline application.

Collections, Judgments, and “Bad Marks”

Not all negative items are created equal. Here’s how apartments typically view them:

Usually not a barrier:

- Medical debt (the three major credit bureaus voluntarily stopped reporting paid medical debts and debts under $500 in 2022, and many communities have followed suit by deprioritizing medical collections)

- Student loans, even if delinquent

- Old collections (5+ years)

- Charge-offs on credit cards

Depends on the community:

- Tax liens

- Recent collections (under 2 years)

- Multiple judgments

Almost always a problem when searching on your own:

- Property debt, This is the big one. Money owed to a previous landlord is treated completely differently than other debt. If you owe a former apartment community $1,500 and it’s sitting in collections, you’ll get denied at most places if you’re applying on your own).

But here’s the thing: I have lots of options for property debt. It’s one of the most common situations I work with. The amount doesn’t matter, I have communities that will work with you.

Limited or No Credit History

First-time renters and recent immigrants face a different challenge: there’s nothing to evaluate. No score, no history, no data.

Your options:

Alternative documentation, Some communities will accept 6 months of bank statements showing consistent deposits, an employment verification letter, or proof of assets.

Cosigner, A creditworthy cosigner (parent, relative, friend) with good credit and sufficient income can get you approved at most communities. They’re equally responsible for the lease, so make sure everyone understands the commitment.

First-time renter programs, A handful of Austin communities specifically market to first-time renters. They’re used to applicants without rental history and have adjusted criteria accordingly.

The good news? No credit is often easier than bad credit. You’re a blank slate, not a risk flag.

Evictions and Broken Leases: The Real Impact on Your Search

This is where I spend most of my time with clients, because evictions and broken leases are the most misunderstood part of rental screening. Most people lump them together. They’re not the same, and the distinction matters for your approval odds.

Broken Lease vs. Eviction: Know the Difference

Broken lease: You terminated your lease early. Maybe you had to relocate for work, maybe you couldn’t afford rent anymore, maybe you just left. It’s a contractual issue, you broke an agreement.

Eviction: A court ordered your removal from the property. There’s a legal judgment against you. It went through the justice system.

Both show up on screening reports. But evictions are viewed more seriously because they involve legal action. A broken lease says “this person left early.” An eviction says “this person had to be legally removed.”

Here’s the nuance: many people say “I have an eviction” when they actually have a broken lease. If you left voluntarily, even if you owed money, that’s typically a broken lease, not an eviction. Pull your records and know which one you actually have.

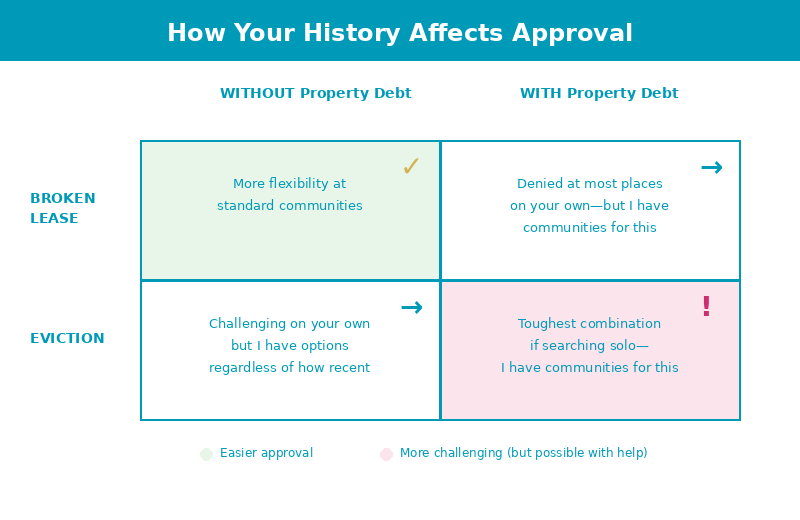

The Property Debt Factor

This is the variable that changes everything, at least when you’re applying on your own).

Broken lease WITHOUT property debt: Standard communities have more flexibility here.

Broken lease WITH property debt: If you’re applying on your own, you’ll likely get denied at most places. But I have communities that work with this situation regularly.

Eviction WITHOUT property debt: Challenging on your own, but I have options regardless of how recent it is.

Eviction WITH property debt: The toughest combination if you’re searching solo. This is exactly where knowing specific community criteria matters, I have communities for this, even if the eviction happened last month.

Property debt is money you owe a previous landlord, unpaid rent, early termination fees, damages, cleaning charges. It often gets sold to a collection agency, which means it might show up under a different company name than your old apartment.

To find it: pull your Experian report and look in the “Potentially Negative” section. The original creditor field should show the apartment community name, even if a collection agency now owns the debt.

Why I Don’t Give You a Timeline Chart

You’ll see other guides with neat little tables: “Eviction under 2 years = limited options, 2-5 years = moderate options,” and so on. I’m not going to do that, because it’s misleading.

The reality is much more nuanced. I’ve gotten people approved weeks after an eviction. I’ve also seen people with older broken leases struggle because of other factor.s. It depends on:

- Whether there’s active property debt

- Your current credit score

- Your income stability

- The specific communities and their ownership groups

- What else is on your record

A lot of locators are inexperienced with these situations. They see “eviction” and immediately steer you toward the same handful of communities they always use, or worse, tell you to wait a few years. That’s lazy, and it leaves people without housing when there are actually options available.

I work with evictions and broken leases of all ages, with and without property debt, regardless of the amount. The timeline and dollar figures matter less than knowing which communities to approach and how to present your application. That’s the difference.

The Payoff Letter Strategy

If you have property debt, paying it off changes your options at standard communities. But there’s a right way and a wrong way to do this.

The process:

- Contact the collection agency (or original creditor if they still hold it)

- Negotiate a settlement, you can often pay less than the full balance

- Critical step: Get the settlement agreement in writing BEFORE you pay

- Pay the agreed amount

- Request a payoff letter (typically arrives within 24-48 hours)

I had a client in South Austin who owed $1,100 in property debt. She called the collection agency, explained her situation, and they agreed to settle for around $550. She paid it, got the payoff letter, and suddenly had access to communities that would have rejected her the day before.

The payoff letter is your proof. It shows the debt is resolved. Many communities that won’t touch active property debt will approve you with a payoff letter in hand.

Important: Get that written agreement before paying. I’ve seen situations where someone pays a “settlement” and then the agency claims it was a partial payment, not a full settlement. Protect yourself.

That said, if you can’t pay off the debt right now, don’t assume you’re stuck. I have communities that work with active property debt, it’s just about knowing where to apply.

Property Debt Amounts

When you’re searching on your own, the size of your debt affects how many denials you’ll get. But I have options regardless of the amount, the debt figure affects which communities we target, not whether I can help you.

Criminal Background: What Can (and Can’t) Be Helped

Criminal background is the topic nobody wants to discuss in detail. Other guides give you vague “felony friendly” claims without explaining what that actually means. Let me be specific.

The Good News First: What’s Usually Not a Problem

DUI/DWI: At most communities, this is a non-issue. It shows up on your background, but the majority of properties I work with don’t deny for DUI alone, especially if it’s not recent.

Simple possession: Minor drug charges, particularly marijuana-related, are increasingly overlooked. Texas hasn’t legalized it, but Austin communities are generally pragmatic about old possession charges.

Most misdemeanors: Theft under a certain amount, minor assault charges that were dismissed, trespassing, these rarely sink an application on their own).

Old charges (7+ years): Time matters enormously. Something from a decade ago carries far less weight than something from last year.

Non-Violent Felonies: Timeframe Is Everything

For felonies without violence, property crimes, white collar offenses, drug possession (not distribution), computer crimes, the key question is: how long ago?

Different communities use different timeframes:

- Some require 7 years from the charge date

- Others require 7 years from the sentencing date (which could be 1-2 years after the charge)

- Some require 10 years

- A few require 20+ years

This is where knowing specific community criteria matters. A felony that’s 8 years from charge but only 6 years from sentencing might qualify at some places and not others.

Deferred adjudication is better than a conviction. If you completed deferred adjudication successfully, make sure that’s clear, it’s not the same as a conviction on your record, and some communities treat it more favorably.

Under 7 years? I still have options. Even with credit issues, we can often find placement. The most important factor. is steady income, I want to see 3x the monthly rent coming in consistently. That’s what gives communities confidence to work with you.

Class A Misdemeanors: The Middle Ground

Class A misdemeanors sit between minor misdemeanors and felonies. These include:

- Assault (depending on circumstances)

- DWI (second offense)

- Evading arrest

- Certain theft charges

For Class A misdemeanors at newer, stricter communities, you’ll typically need:

- Credit score of 600 or above

- Income of 3x monthly rent

- If self-employed: tax returns required (pay stubs won’t cut it)

Older communities or those with flexible screening may have more room to work with you.

Violent Felonies: It’s About Income

Assault, robbery, domestic violence, these require more specific placement. The key requirements:

- Credit typically needs to be 600+

- Income of 3x rent is essential, steady, verifiable income is the #1 factor.

- 7+ years helps, but I have options for more recent situations too

If you’re searching on your own with a violent felony, you’ll hit a lot of dead ends. But I’ve helped people with violent felony backgrounds find housing. It takes knowing exactly which communities to approach, and that’s what I do. Steady income is what makes it possible.

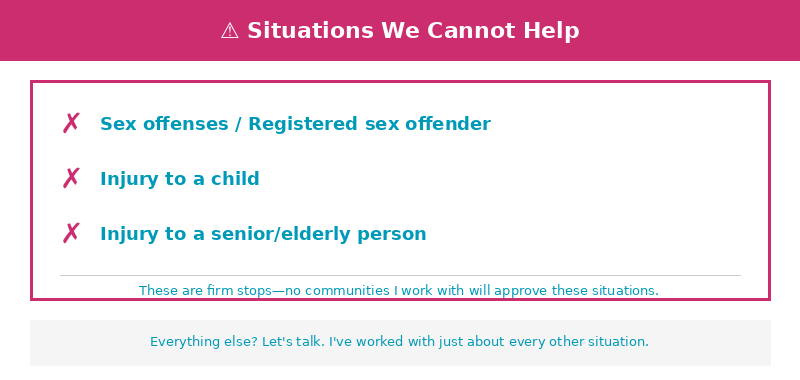

What Absolutely Disqualifies

I need to be direct about situations I cannot help with:

- Sex offenses / Registered sex offender, No communities I work with will approve this

- Injury to a child, Universal disqualifier

- Injury to a senior/elderly person, Universal disqualifier

Active parole with violent felony: This one’s not an automatic no, but the requirements are strict. I do have communities that will work with you, but you’ll need credit above 600 and income of at least 3x the monthly rent. No exceptions on those numbers.

These aren’t “difficult” situations, they’re firm stops. If this is your situation, I’m sorry, but I don’t have pathways to offer. I’d rather tell you now than take your time and give you false hope.

Third-Party Approval: The Process Nobody Else Explains

This is information you won’t find anywhere else online. I’ve searched. Competitors mention “case by case” or “conditional approval” but never explain the actual mechanism. Third-party approval is how many people with recent evictions or significant issues actually get into apartments.

What Third-Party Approval Actually Is

Think of it as insurance for the apartment community.

When you apply and the screening flags an issue, recent eviction, active property debt, multiple problems, the community has a choice. They can deny you outright, or they can offer third-party approval.

A third-party company steps in and essentially underwrites the risk. They evaluate your specific situation, determine a fee based on that risk, and if you pay it, they guarantee the lease to the community. If you later default, the third-party company covers the community’s losses.

It’s not a loan. You’re not borrowing money. It’s a one-time fee that makes you an acceptable risk.

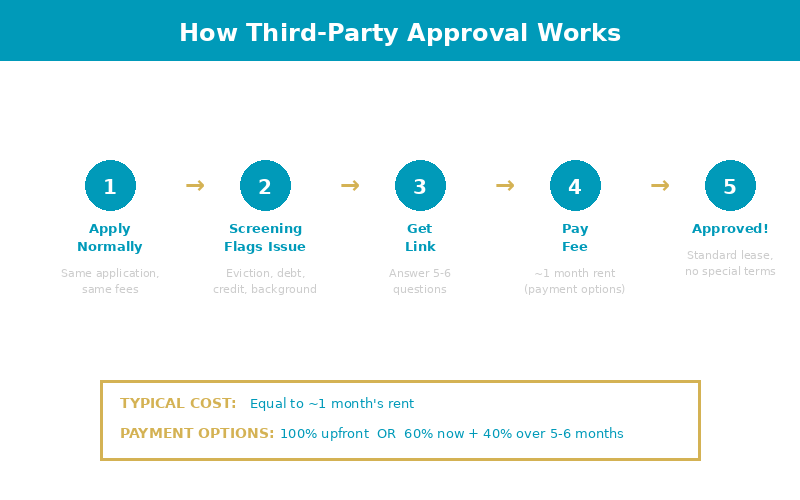

The Complete Process (What Actually Happens)

Here’s the step-by-step:

- You apply to the community normally, Same application, same fees

- Screening flags your issue, Eviction, property debt, credit, background

- Community offers third-party option, Instead of outright denial

- You receive a link, To the third-party service’s portal

- You answer 5-6 questions, About your situation, income, circumstances

- They run a soft credit pull, Doesn’t hurt your score

- You receive a fee quote, Based on their risk assessment

- You pay the fee, Options below

- Community is notified instantly, Lease prepared as a standard agreement

Once you pay, your lease is completely normal. No special terms, no ongoing fees, no mark against you. It’s a standard lease agreement.

What It Costs (Real Numbers)

The fee is typically equal to one month’s rent. If you’re renting a $1,400 apartment, expect around $1,400 for third-party approval.

Payment options:

- 100% upfront, Pay it all before move-in

- 60% upfront + 40% spread out, Pay 60% now, remaining 40% over 5-6 months added to your rent

Some people balk at this cost. I get it, it’s significant. But think about what you’re actually paying for: approval at a community that would have denied you, avoiding another round of application fees at places that might also deny you, and getting into housing now instead of waiting years for your record to age.

When Third-Party Makes Sense

Third-party approval is worth it when:

- Your eviction is recent (under 2 years) and you have property debt

- You have multiple issues that combine to disqualify you at most places

- You need a specific community for location, schools, work proximity

- It’s genuinely your best or only option after exploring alternatives

When to Avoid Third-Party

Don’t use third-party approval if:

- Other communities will approve you without it, This is where working with me helps. I’ve had clients ready to pay a $1,500 third-party fee when I knew a community five minutes away that would approve them without it. That’s $1,500 back in their pocket.

- You can pay off property debt for less than the third-party fee would cost

- Your issue is old enough that standard communities will work with you

The key is knowing your options before you commit to the fee. That’s exactly what I help clients figure out.

The Third-Party Companies

The main players you might encounter are services like Jetty, Rhino, or property-specific programs. Each community has relationships with specific providers, you don’t get to shop around. The community tells you which service they use.

These aren’t scams. They’re legitimate risk mitigation services that have become standard in the industry as communities look for ways to fill units while managing risk. The National Apartment Association has documented the growth of these services as apartment operators seek flexible screening solutions.

Income Verification: The SNAAPT Trap (And How to Get Through It)

This section exists because I’ve watched too many applications get delayed, or denied, over something completely avoidable. Income verification has changed significantly in the past few years, and most renters have no idea what they’re walking into.

What Is SNAAPT?

SNAAPT is an anti-fraud income verification system that a growing number of Austin apartment communities now use. Instead of a leasing agent glancing at your pay stub and checking a box, SNAAPT connects directly to your bank account and payroll provider to verify that your income documents are legitimate.

It’s designed to catch falsified pay stubs, which, yes, people do submit. But it also catches innocent mistakes that can torpedo your application.

The Critical Mistake That Delays Applications

Here’s what happens constantly:

You download your pay stub from your payroll provider. You rename the file from “paystub_123456.pdf” to “John_Smith_Paystub_January.pdf” so it’s easier to find. You upload it to the application.

SNAAPT rejects it.

Why? Because the system checks file metadata to ensure documents come directly from the source. When you rename a PDF, or open it and re-save it, or screenshot it, or do anything other than upload the original file, SNAAPT flags it as potentially manipulated.

You didn’t do anything wrong. You were just organizing your files. But now your application is delayed, the leasing office is asking for documents again, and you’re stressed about a unit you wanted.

The fix: Download your pay stubs directly from your payroll provider (ADP, Gusto, Paychex, whatever your employer uses). Do not rename the files. Do not open them. Upload them exactly as downloaded.

Self-Employed and Gig Workers: Your Income Is “Ugly”

I use this term with clients because it’s accurate. If your income comes through Cash App, Venmo, PayPal, or Zelle, apartment communities are going to have a hard time verifying it.

SNAAPT’s connections with these payment apps are, in my experience, very faulty. The verification fails, the amounts don’t match up, or the system can’t categorize the income properly.

What you need instead:

- Tax returns: This is the gold standard for self-employed income. Your most recent year’s return showing your adjusted gross income.

- 6 months of bank statements: Showing consistent deposits that demonstrate your income pattern.

- Employment offer letter: If you’ve recently been hired (within 30 days), a formal offer letter on company letterhead stating your salary can work at many communities.

The strong credit shortcut: If you’re self-employed but have good credit (generally 650+), I have communities that don’t verify income at all. They look at your credit history and trust that you’re responsible. This is a game-changer for freelancers and business owners who have solid financials but messy documentation.

If you’re a gig worker (Uber, DoorDash, Instacart, freelance) without strong credit, start gathering your bank statements now. Don’t wait until you’re applying. Six months of statements showing regular deposits gives communities confidence that your income is real and consistent.

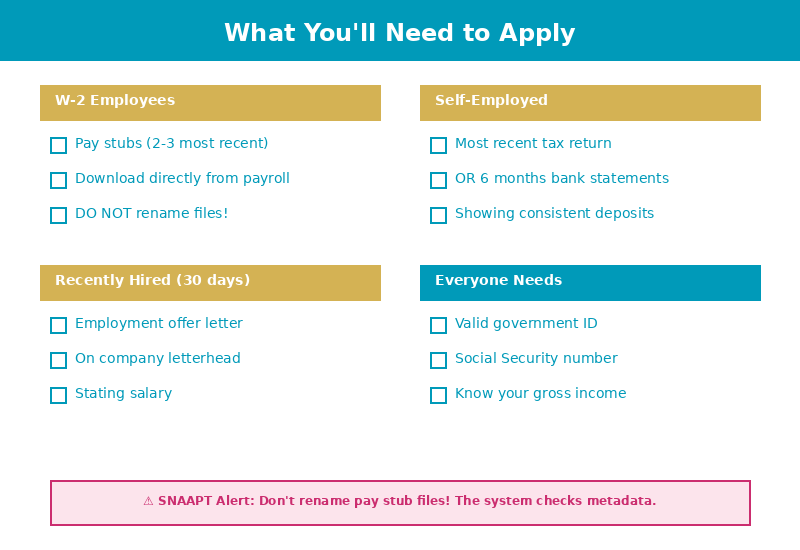

How to Prepare Before You Apply

Before submitting any application:

- Download pay stubs fresh from your payroll portal, don’t use old downloads

- Don’t modify file names or open/re-save the documents

- Have bank statements ready as backup, especially if you have any non-W2 income

- Know which communities have stricter verification, this is something I can tell you upfront

The verification systems are getting more sophisticated, not less. Communities are investing in fraud prevention because they’ve been burned by falsified documents. Understanding how the system works keeps you from getting caught in a net designed for actual fraudsters.

Where to Look: Austin’s Second Chance Apartment Landscape

Now let’s talk geography. Where you look in Austin matters as much as what’s on your record. Some areas have abundant second-chance inventory. Others have almost none.

Why the Current Market Works in Your Favor

Austin’s apartment market has shifted dramatically from where it was in 2021-2022. Back then, vacancy rates were below 5%, communities had waitlists, and screening criteria was strict because landlords could afford to be picky.

Today? Vacancy rates hit 10.2% in Q3 2025, according to Cushman & Wakefield. Rents have dropped roughly 5% year-over-year, Yardi Matrix data shows Austin with the weakest rent performance among major metros. Thousands of new units have delivered over the past two years.

What does this mean for you?

Communities that would have rejected your application two years ago are now willing to work with you. They have empty units. Empty units don’t pay the bills. A tenant with an eviction from three years ago who can pay rent today is better than an empty unit.

According to CoStar research, roughly 65% of Austin apartment complexes offered some sort of concession in 2025. I’m seeing specials I haven’t seen in years: up to 8-12 weeks free rent, gift cards up to $3,000, waived admin fees, reduced deposits. These concessions signal that communities are competing for tenants, including tenants they might have previously turned away.

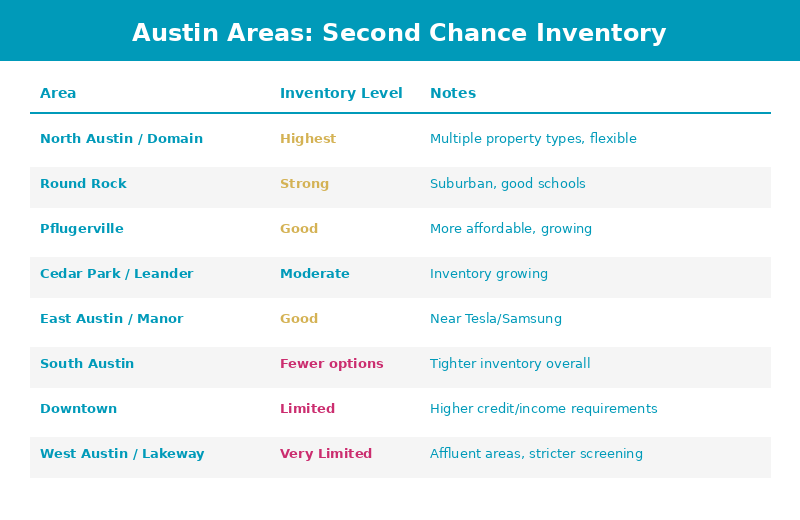

Austin Area Breakdown for Second Chance Renters

Not every part of Austin has equal second-chance inventory. Here’s what I’m seeing:

| Area | Second Chance Inventory | Notes |

|---|---|---|

| North Austin / Domain area | Highest concentration | Multiple property types, newer construction, many flexible communities |

| Round Rock | Strong options | Suburban, good schools nearby, solid second-chance inventory |

| Pflugerville | Good coverage | More affordable than Round Rock, growing inventory |

| Cedar Park / Leander | Moderate options | Inventory growing as area develops |

| East Austin / Manor | Good options | Near Tesla and Samsung facilities, newer development |

| South Austin | Fewer options | Tighter inventory overall, but some communities work with second-chance |

| Downtown | Limited | Higher credit and income requirements at most high-rises |

| Kyle / Buda | Some options | Further out but more affordable, growing |

Where Options Are Genuinely Limited

I want to be honest about areas where second-chance renters will struggle:

West Austin / Lakeway / Westlake: Very limited apartment inventory in general, and what exists tends to have stricter screening. These are affluent areas with fewer rental communities and less flexibility.

Luxury high-rises downtown: The Class A towers with concierge service and rooftop pools typically have higher credit and income thresholds. It’s less about them being inflexible on background issues and more about the baseline requirements being 650+ credit and 3x income with no wiggle room. If you meet those numbers, you may have options even with other issues on your record.

Brand-new lease-ups: This is counterintuitive. You’d think new communities desperate to fill units would be flexible. Sometimes they are. But many new properties start with strict criteria and only loosen up later if they’re struggling to lease. It’s worth asking, but don’t assume.

The Geographic Strategy

If you have flexibility on where you live, here’s my advice:

Start your search in North Austin, Round Rock, and Pflugerville. These areas have the highest concentration of communities I work with that offer flexible screening. You’ll have more options to compare, better negotiating position on specials, and higher odds of approval.

Expand to East Austin and Cedar Park/Leander if you need to be closer to specific employers or have other geographic requirements.

Save South Austin and Downtown for situations where you have to be there. The inventory is tighter, and Downtown’s higher credit and income thresholds make it challenging for some situations.

This isn’t about where’s “better” to live, it’s about where your odds of approval are highest given your situation. And honestly, this is where working with me saves you weeks of frustration. I already know which communities in each area will work with your specific circumstances.

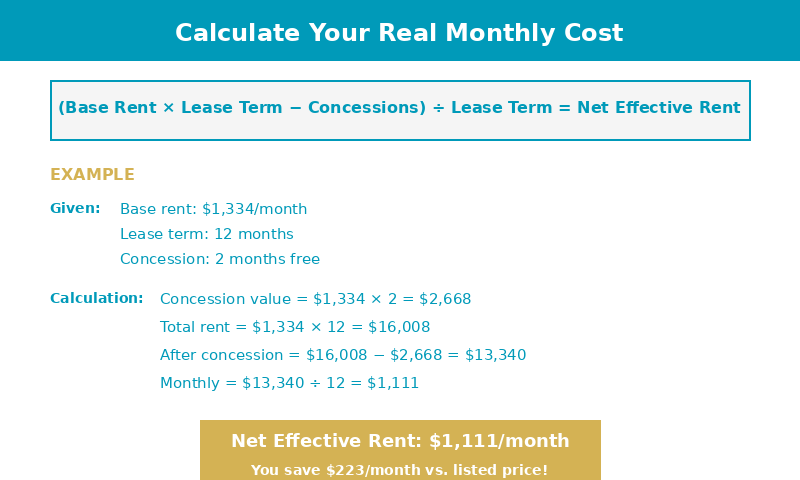

Net Effective Rent: What You’ll Actually Pay

With all the specials available right now, sticker price is meaningless. What matters is what you’ll actually pay over your lease term. This is called net effective rent, and understanding it can save you hundreds of dollars, or help you realize a “more expensive” apartment is actually cheaper.

The Formula

Real Example

Let’s say you’re looking at an apartment listed at $1,334/month. The community is offering 2 months free on a 12-month lease.

Here’s the math:

- Base rent: $1,334

- Lease term: 12 months

- Concessions: $1,334 x 2 = $2,668

Calculation: ($1,334 x 12 – $2,668) / 12 = $1,111 net effective rent

That’s $223 less per month than the listed price. Over the full lease, you’re saving $2,668.68.

Why This Matters for Second Chance Renters

You might face a higher deposit because of your credit or rental history. That stings upfront. But if the community is offering 6-8 weeks free rent, the math often works out in your favor over the lease term.

I always run these calculations with clients because it changes how you compare options. A $1,400 apartment with 2 months free beats a $1,300 apartment with no specials.

What to Look For Right Now

- Months free: The biggest savings, look for 6-12 weeks free

- Gift cards: Some communities offer $500-$3,000 gift cards at move-in

- Reduced deposits: Especially valuable if your deposit would otherwise be high

- Waived fees: Application fees, admin fees, amenity fees

How to Apply (And Not Waste Money)

Application fees add up fast. I’ve talked to people who spent $500, $800, even over $1,000 applying to places that were never going to approve them. Here’s how to avoid that.

Before You Apply: Know Your Situation

Pull your credit report at AnnualCreditReport.com before you do anything else. Check the “Potentially Negative” section on Experian for property debt. Know your exact gross income, not take-home, gross. And be honest with yourself about any background issues.

The more accurately you understand your situation, the better I can match you with communities that will actually approve you. No guessing, no wasted fees.

What Documents You’ll Need

W-2 employees:

- Pay stubs (downloaded directly from payroll provider, don’t rename files)

- 2-3 most recent stubs typically required

Self-employed:

- Most recent tax return, or

- 6 months of bank statements showing consistent deposits

Recently hired (within 30 days):

- Employment offer letter on company letterhead stating salary

Everyone:

- Valid government ID

- Social Security number

Timing: You Don’t Need to Apply On-Site

Some people think they need to fill out an application during their tour. You don’t. Most communities give you 24-48 hours to apply and still lock in the pricing and specials you discussed.

Take that time. Make sure you have your documents ready. Apply when you’re prepared, not when you’re pressured.

The Honesty Rule

I tell every client the same thing: if you lie, they will deny.

Undisclosed issues, an eviction you didn’t mention, a felony you hoped wouldn’t show up, income you exaggerated, result in automatic denial. You lose your application fee, your admin fee, and your shot at that unit.

Tell me everything upfront. I’ve heard it all. There’s nothing you can tell me that will shock me, and knowing your full situation lets me point you toward communities that will actually work with you.

Let’s Be Honest: Situations I Can’t Help With

I’d rather be upfront about my limitations than waste your time.

Absolute Disqualifiers

These are situations where I don’t have pathways to offer:

- Sex offenses / Registered sex offender

- Injury to a child

- Injury to a senior/elderly person

If this is your situation, I’m genuinely sorry. I wish I had options for you, but I don’t.

Why I’m Telling You This

Because I want you to be honest with me about your situation. The more I know, the better I can match you with communities that will actually approve you. I’m not here to judge, I’m here to find you housing.

The only true stops are sex offenses and injury to a child or elderly person. Everything else? Let’s talk. You’ll need to show 3x the monthly rent in income (or an offer letter if you’re starting a new job), but if you’ve got that, I can work with just about any combination of issues.

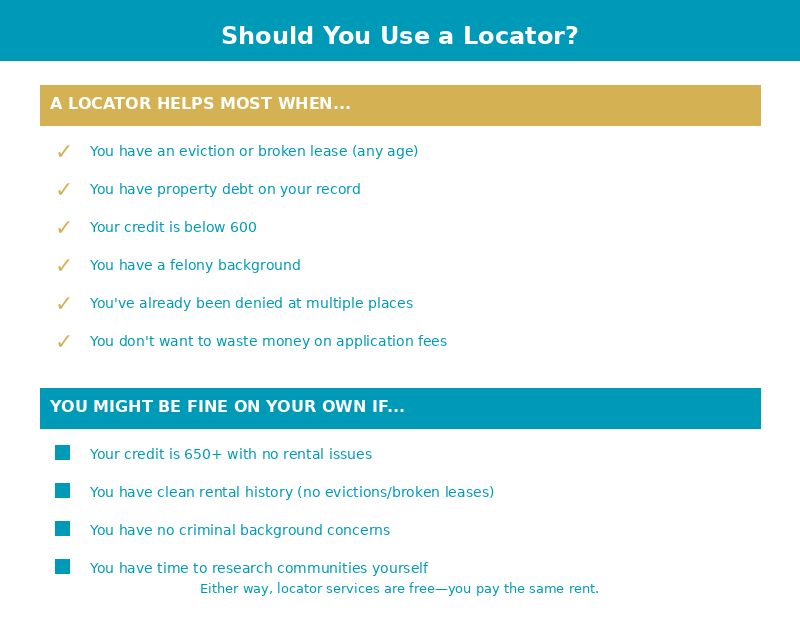

Why Work With an Apartment Locator? (And How We Get Paid)

Fair question. Let me explain the model.

The Win-Win-Win

- You win: Free research, a curated list of communities that will actually approve your situation, advocacy during the application process, and someone who knows screening criteria so you stop wasting money on applications

- The community wins: They get a qualified tenant they might have missed otherwise

- I win: I receive a referral fee from the community’s marketing budget

The Key Point: Your Rent Is the Same

Whether you use a locator or find the apartment yourself, your rent is identical. The community pays my fee out of their marketing budget, the same budget they’d spend on Apartments.com ads or Google clicks. You don’t pay more. There’s no markup.

What You Actually Get

- Screening knowledge, I know which communities will approve your specific situation before you apply

- Avoided wasted fees, No more $50-100 application fees at places that were going to deny you

- Negotiation: I’m happy to ask for better specials, reduced deposits, or waived fees (most clients don’t think to negotiate)

- Advocacy, If your application hits a snag, I’m on the phone with the leasing office working it out

- Continued support, Questions after move-in? I’m still here

Licensed and Regulated

I’m licensed through the Texas Real Estate Commission (TREC). In Texas, apartment locating requires a real estate license, this isn’t a side hustle or a referral scheme. It’s a regulated profession with professional standards and accountability.

Frequently Asked Questions

What credit score do I need for a second chance apartment in Austin?

I work with all credit scores. The communities I can place you at vary based on your score, 600+ opens the most doors, but I have options for 550-600, 500-550, and even below 500. Strong income (3x rent) helps, but I can work with property debt at any credit level. The score is just one factor..

Can I get approved with an eviction on my record?

Yes. It doesn’t matter how recent it is, I work with evictions of all ages. Whether you have active property debt from that eviction also matters, but I have communities for both situations. A lot of locators don’t have experience with this and will tell you to wait. You don’t have to.

How much does third-party approval cost?

Typically equal to one month’s rent. You can pay 100% upfront or about 60% upfront with the remaining 40% spread over 5-6 months. It’s a one-time fee, once paid, your lease is completely standard.

What income do I need to qualify?

Most communities require 3x the monthly rent in gross household income. Some accept 2.5x or 2x. With third-party approval, a 3x requirement can sometimes drop to 2x but we can go over that before you tour and apply to make sure you have all the correct info. All applicants’ incomes combine, so roommates or partners count together.

Are apartment locators really free?

Yes. I’m paid a referral fee by the apartment community from their marketing budget. Your rent is exactly the same whether you use me or not. There’s no catch.

What if I have both bad credit AND a broken lease?

Multiple issues don’t eliminate your options, they just mean you need to know exactly where to apply. If you’re searching on your own, you’ll waste a lot of money on application fees at places that were never going to approve you. The key factor.s are: how recent are the issues, is there active property debt, and what’s your current income? This is exactly why working with someone who knows specific community criteria helps, I can tell you upfront which places will work with your combination, so you’re not throwing money away.

What’s the difference between an eviction and a broken lease?

A broken lease is early termination of your lease agreement, a contractual issue. An eviction is court-ordered removal, a legal judgment. Both show on screening reports, but evictions are generally viewed more seriously. Many people think they have an eviction when they actually have a broken lease.

Does bankruptcy disqualify me from renting?

Usually not. Most communities work with discharged bankruptcies (completed, debts cleared). Even open Chapter 13 bankruptcy can work if your payments are current. You’ll still need to meet income requirements and ideally have credit that’s starting to recover.

How long do evictions stay on my record?

Evictions can remain on your record for up to 7 years under the Fair Credit Reporting Act. Time does matter, an eviction from 5 years ago is viewed differently than one from 5 months ago. But I have communities for both situations. You don’t have to wait.

What areas in Austin have the most second chance apartments?

North Austin and the Domain area have the highest concentration. Round Rock and Pflugerville also have strong inventory. East Austin and Cedar Park/Leander have moderate options. South Austin and Downtown have fewer options, not because communities won’t work with issues, but because Downtown especially has higher credit and income thresholds.

Ready to Find Your 2nd Chance Apartment?

Here’s what happens next if you want my help – just fill out the form here.

We’ll have a quick conversation, 5-10 minutes, where you tell me your situation. Credit score, income, any evictions or broken leases, any background issues. I need the full picture to help you.

If I can help, you’ll get a curated list of communities that will actually approve you within 24-48 hours. No generic listings. Specific properties where I know the screening criteria and believe you have a real shot.

If I can’t help, if your situation is one of the few I genuinely don’t have options for, I’ll tell you that too. I’d rather be honest upfront than waste both our time.

No judgment. I’ve heard it all. Just tell me what’s going on and let’s figure out your options.

About Ross Quade

Ross Quade is a licensed Texas REALTOR® and the founder of Austin Apartment Team. He helps renters find apartments across the Austin metro—and his service is completely free. (The apartment communities pay him, not you.)

He and his team have toured over 500 properties at this point. They’ve helped hundreds of renters navigate this market, from first-timers to people relocating from out of state to folks with complicated situations. Fill out the short form or call Ross at 512-943-6859.

Going to tour on your own? No problem. Just do these 3 things:

- On your tour: Tell them “My apartment locator, Ross Quade, referred me.” Then ask them to note it in your file.

- On your application: Look for the referral field on your application and enter “Ross Quade – Austin Apartment Team.”

- After you apply: Text 512-943-6859 and let me know where you applied.

That referral costs you nothing, lets me follow up if your application gets stuck, and keeps me in your corner if I need to advocate for you.